Unraveling Common Misconceptions About Health Insurance

Health insurance is a complex and often misunderstood aspect of our lives. With a myriad of policies, terms, and conditions, it’s no surprise that misconceptions abound. Addressing these misconceptions is crucial, not just for making informed decisions but for ensuring you and your loved ones are adequately covered. Let’s dive into some of the most common myths and clarify what health insurance really entails.

1. Myth: Health Insurance Covers Everything Medical

- Reality: This is a common misconception. In reality, health insurance policies have specific inclusions and exclusions. While they typically cover a range of medical services and treatments, certain things like cosmetic procedures or experimental treatments might not be included. Understanding the specifics of your policy is key to knowing what’s covered and what’s not.

2. Myth: I Can’t Get Insurance Because of My Pre-existing Condition

- Reality: Thanks to changes in legislation, this is no longer true. Most health insurance plans can’t deny you coverage or charge you more because of a pre-existing health condition. It’s important to know your rights and the protections in place for individuals seeking coverage.

3. Myth: Lower Premiums Always Mean More Savings

- Reality: A lower premium might seem appealing, but it often comes with higher deductibles and out-of-pocket costs. It’s crucial to balance the premium with other associated costs. Sometimes, a plan with a slightly higher premium might be more cost-effective in the long run, especially if you require regular medical care.

4. Myth: I Don’t Need Health Insurance If I’m Young and Healthy

- Reality: Health insurance is not just for when you’re ill. It’s a crucial safety net for unexpected medical emergencies, which can happen to anyone, regardless of age or health. Plus, preventative care covered under insurance can help maintain your health and catch potential issues early.

5. Understanding Your Coverage: The Inclusions and Exclusions

- Every health insurance policy has its set of rules regarding what is covered and what is not. Common inclusions are doctor’s visits, hospital stays, and preventive care. Exclusions can include elective surgeries, long-term care, and services deemed not medically necessary. It’s essential to read the fine print of your policy and speak with your insurance provider for a clear understanding of your coverage.

6. Myth: My Premium is the Only Cost I Need to Worry About

- Reality: Your premium is just the beginning. It’s the regular payment you make to keep your insurance active, but other costs like deductibles, copays, and coinsurance also play a significant role in your overall healthcare expenses. A low premium might mean higher out-of-pocket costs when you actually receive medical care, so consider the total cost.

7. Myth: Health Insurance is Just Expensive, No Matter What

- Reality: Many factors influence the cost of insurance premiums, including your age, location, tobacco use, plan category, and whether the plan covers dependents. Subsidies or government assistance, like those offered through Covered California, can also make premiums more affordable for those who qualify.

8. Myth: Pre-Existing Conditions Mean No Coverage or Sky-High Rates

- Reality: Current laws prevent insurance companies from refusing coverage or charging more for pre-existing conditions. This protection means that your health history won’t prevent you from getting coverage or change how much you pay in premiums.

9. Myth: I’m Covered by My Employer, So I Can’t Shop for a Better Plan

- Reality: Employer-based insurance is a common benefit, but it’s not always the best or only option. Employees are free to explore the Health Insurance Marketplace to find plans that might better suit their needs or budget, especially if they qualify for subsidies.

10. Myth: If I Change Jobs, I Lose My Health Insurance Immediately

- Reality: While it’s true that leaving a job typically means losing employer-based insurance, protections are in place. Programs like COBRA allow you to keep your employer’s insurance for a limited time, and losing your job qualifies you for a Special Enrollment Period to get insurance through the Marketplace.

11. Understanding Employment Impact on Insurance

- Your job affects your health insurance options. While many employers offer insurance, the cost and coverage can vary widely. It’s important to compare your employer’s insurance with other available options to ensure you have the best coverage for your needs. Remember, being informed about your options can lead to better coverage and potentially save you money.

By dissecting these myths and understanding the truths behind insurance costs, premiums, and employment’s impact, you can take charge of your health insurance decisions with confidence and clarity.

Decoding Health Insurance: Government Assistance and Smooth Enrollment

Understanding government health programs and navigating the enrollment process are pivotal to securing the right health insurance. Let’s clarify how programs like Covered California assist individuals and simplify the enrollment steps, and then delve into what to anticipate with policy changes and renewals.

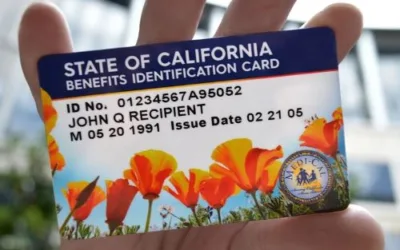

12. Government Programs and Assistance Explained

- Fact: Covered California is the state’s marketplace for the Affordable Care Act (ACA). It offers a range of health insurance plans that meet government standards for coverage. These plans are designed to be affordable, with costs based on your income. Many individuals qualify for financial assistance to lower their premium costs, and they might also be eligible for cost-sharing reductions that lower the amount they pay for health care services.

13. The Enrollment Process Demystified: A Step-by-Step Guide

- Step 1: Check Eligibility – Determine if you qualify for financial aid and what types of plans are available for you.

- Step 2: Compare Plans – Evaluate the different plans’ costs, benefits, and provider networks.

- Step 3: Enroll – Choose a plan and enroll either online, by phone, or with the help of a certified enroller.

- Step 4: Confirm Enrollment – Ensure that you receive confirmation and understand when your coverage begins.

14. Understanding Policy Changes and Renewals

- Insight: Health insurance policies are bound by terms that typically conclude within a year. Upon renewal, you should review your plan as changes can occur in premiums, benefits, or even your own health care needs. Open Enrollment is the perfect time to make any needed changes to your plan. Additionally, life events such as getting married or having a child can qualify you for a Special Enrollment Period to make changes outside of the usual Open Enrollment.

15. Expert Insights: Straight from the Professionals

- Expert Opinion: Insurance professionals emphasize the importance of understanding your policy and staying informed about any changes in the law or your personal circumstances that could affect your coverage. “Staying proactive about your health insurance is the key to ensuring you have the coverage you need when you need it,” says a seasoned Covered California advisor.

By providing accurate information about government programs and simplifying the enrollment and renewal processes, this section aims to empower you with knowledge and confidence. Hearing directly from the experts adds an extra layer of credibility, ensuring that you are getting reliable and actionable advice.

From Misconception to Empowerment: Real Stories and Resources

Unpacking misconceptions about health insurance isn’t just about correcting false information—it’s about understanding the real impact these beliefs can have on individuals’ lives. Here, we share stories that highlight the consequences of misconceptions, provide resources for further education, and wrap up with a knowledge-empowering conclusion.

16. Real Stories: The Impact of Misconceptions

- Case Study: Meet Jane, who thought her pre-existing condition would prevent her from getting affordable coverage. For years, she went uninsured, risking financial and health catastrophes. When she finally learned the truth, that the ACA prohibits such denials, she was able to get the coverage she needed and manage her health proactively.

17. Educational Resources and Tools

- Resource List: To continue learning about health insurance, visit:

- Covered California’s official website for comprehensive guides and plan comparisons.

- The Kaiser Family Foundation for in-depth articles and analysis on health policy.

- Healthcare.gov for resources on federal health insurance programs and subsidies.

18. Empowering with Knowledge: The Final Word

- Message: Overcoming misconceptions is more than correcting wrongs—it’s about empowering yourself with the knowledge to make informed health insurance decisions. Staying informed means staying protected, ensuring you and your loved ones have the coverage you need for a healthy, secure future.

Final Thoughts

In navigating the complex landscape of health insurance, knowledge truly is power. This guide has aimed to dismantle prevalent misconceptions, provide actionable insights, and answer pressing questions. Remember, every step taken to understand your health insurance options strengthens your ability to make informed decisions, ensuring that you and your loved ones have the coverage you need to maintain your health and well-being. Stay curious, stay informed, and take charge of your health insurance journey.

This article was written by Mark Svetlik, with the assistance of automation technology. The content has undergone thorough editing and fact-checking to ensure complete accuracy.