How to Choose a Health Insurance Plan and Save with Covered California

Choosing the right health insurance plan is not just a financial decision but a critical step that can significantly affect your well-being and peace of mind. This comprehensive guide aims to simplify your decision-making process by offering updated and detailed information on the types of health insurance plans available, key financial aspects to consider, personal factors that should influence your choice, and more.

Types of Health Insurance Plans

Navigating the maze of health insurance plans can be confusing. Here’s a breakdown of the commonly offered types of plans to help you better understand your options:

Health Maintenance Organizations (HMOs)

Pros: Lower premiums, Comprehensive services

Cons: Limited network of doctors, referrals required for specialists

HMOs offer a range of services through a network of healthcare providers. You usually need to choose a primary care physician (PCP) and get referrals from them to see specialists.

Preferred Provider Organizations (PPOs)

Pros: Flexibility in choosing healthcare providers, no need for a PCP

Cons: Higher out-of-pocket costs, premiums can be expensive

PPOs give you the freedom to visit any healthcare provider but offer lower costs if you use their network of doctors.

Exclusive Provider Organizations (EPOs)

Pros: Lower premiums if you stick to the network

Cons: No coverage outside the network except in emergencies

EPOs require you to use healthcare providers in their network, excluding out-of-network care unless it’s an emergency.

Point of Service (POS) Plans

Pros: More flexibility than HMOs, in-network and out-of-network coverage

Cons: Need for referrals, higher out-of-pocket costs than HMOs

POS plans blend features of HMOs and PPOs. You choose a primary care physician via an HMO-like network, but can go out-of-network at a higher cost.

High-Deductible Health Plan (HDHP)

Pros: Lower premiums, tax advantages with Health Savings Accounts

Cons: High out-of-pocket costs before coverage kicks in

HDHPs offer lower premiums and are usually paired with a Health Savings Account (HSA), allowing you to set aside money for healthcare expenses tax-free.

When comparing health insurance plans, pay attention to these key aspects:

- Premiums: This is the amount you pay each month for your insurance. It’s tempting to choose the plan with the lowest premium, but remember that a lower premium often means higher out-of-pocket costs when you need care.

- Deductibles: Plans with lower monthly premiums usually have higher deductibles. The concept of a deductible varies among individual and group insurance policies. Generally, it’s the amount you must pay out-of-pocket for medical services before your insurance plan begins to contribute. In individual marketplace plans like those offered through Covered California, essential health benefits like preventive care, certain primary care visits, and sometimes prescription medications may be covered without needing to meet the deductible. However, in many group policies offered by employers, you might need to meet the deductible first before any coverage kicks in, depending on the plan specifics. Always read the Summary of Benefits and Coverage (SBC) carefully to understand the particulars of the deductible in the plan you’re considering.

- Copayments and Coinsurance: These are your share of the costs of a health care service, usually expressed as a fixed amount (copayment) or a percentage (coinsurance) that you pay after you’ve paid your deductible.

- Out-of-pocket Maximums: This is the most you have to pay for covered services in a plan year. After you reach this limit, your health insurance will pay 100% of the costs of covered benefits.

- Coverage: This refers to the medical services that are included in the plan. It’s crucial to ensure that the services you need or anticipate needing are covered.

Factors to Consider When Choosing a Plan

Once you’ve compared different plans, the next step is to consider your personal needs and circumstances. Here are some factors to bear in mind:

- Your Health Status: If you have a chronic illness, you may need a plan that has a broad coverage and lower out-of-pocket costs. If you’re generally healthy, a plan with a higher deductible but lower premiums may be a cost-effective choice.

- Your Preferred Doctors and Hospitals: If you have preferred doctors or specialists, make sure they are in-network for the plan you’re considering.

- Prescription Drugs: If you regularly take certain medications, ensure they are covered by the plan.

- Your Budget: Consider what you can afford to pay in premiums, deductibles, and other out-of-pocket costs.

- Life Changes: Anticipate any major life changes that could affect your health insurance needs, such as planning to start a family or undergoing a major surgery.

Finding a Plan that Meets Your Needs

Armed with a comparison of plans and an understanding of your needs, you are now better positioned to find a plan that suits you.

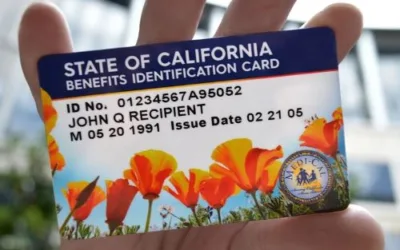

In the United States, you can purchase health insurance through the Health Insurance Marketplace during the open enrollment period or a special enrollment period if you qualify. You can compare and choose plans on the Marketplace website.

Employers also often provide health insurance as part of their benefits package. If you’re employed, check with your human resources department about your options.

Finally, consider seeking the help of an insurance broker or an independent agent if you’re finding the process overwhelming. They can provide personalized advice and simplify the process for you.

Frequently Asked Questions (FAQs)

In this section, we address some of the most frequently asked questions about choosing a health insurance plan. While this isn’t an exhaustive list, it covers some key areas of concern for most people.

What is a Premium?

A premium is the monthly fee you pay to maintain your health insurance coverage. It’s separate from any out-of-pocket expenses like deductibles, copayments, or coinsurance.

Do I Have to Pay the Deductible for Every Service?

Not necessarily. Many plans cover essential services like preventive care without requiring you to meet the deductible first. However, this can vary by plan and provider, so check your Summary of Benefits and Coverage (SBC).

What’s the Difference Between In-Network and Out-of-Network?

In-network providers have a contract with your insurance company to provide services at a reduced rate. Going out-of-network usually means higher out-of-pocket costs, and some plans may not cover out-of-network care at all unless it’s an emergency.

How Do I Know If My Doctor Is In-Network?

Contact your insurance provider or check their website to see if your preferred healthcare providers are within their network. You can also ask the doctor’s office directly about which insurance plans they accept.

What Are Copayments and Coinsurance?

Both are your share of the cost for a covered health service, paid after you’ve met your deductible. A copayment is usually a fixed amount, whereas coinsurance is a percentage of the total cost of the service.

What is an Out-of-Pocket Maximum?

This is the most you’ll have to pay for covered services within a plan year. After you reach this limit, your insurance will cover 100% of covered benefits.

What If I Have a Pre-existing Condition?

Under the Affordable Care Act, insurance companies can’t refuse to cover you or charge you more due to pre-existing conditions.

How Does Coverage Change If I’m Expecting a Baby or Planning to?

Some plans offer maternity and newborn care as part of their essential benefits. Consider your needs for services like prenatal and postnatal visits, delivery, and newborn care when choosing a plan.

Can I Change My Plan Mid-Year?

Generally, you can only change your health insurance plan during the open enrollment period. Exceptions are made for qualifying life events like marriage, having a baby, or losing other health coverage.

What Is a High-Deductible Health Plan (HDHP) and Is It Right for Me?

High-Deductible Health Plans are increasingly becoming a choice for individuals and families looking for lower monthly premiums and more control over their healthcare spending. One of the key benefits of opting for an HDHP is the ability to pair it with a Health Savings Account (HSA), offering both immediate and future financial advantages.

Qualifying for an HSA

Not all high-deductible plans are HSA-eligible. To qualify, the plan must meet specific criteria set by the IRS, including a minimum deductible and a maximum out-of-pocket amount. Always check with the plan provider to confirm if a particular HDHP is HSA-eligible.

Benefits of an HSA

An HSA offers triple tax advantages:

- Tax-Deductible Contributions: Money you contribute to your HSA can be deducted from your income, reducing your tax liability for the year.

- Tax-Free Growth: Any interest or other earnings on the money in your HSA grow tax-free.

- Tax-Free Withdrawals: Funds withdrawn from the HSA for qualified medical expenses are not subject to federal taxes.

Lower Premiums and More Control

HDHPs typically have lower premiums compared to plans with lower deductibles. This can be beneficial if you’re generally healthy and don’t anticipate needing frequent medical services. Additionally, an HSA gives you more control over how you spend your healthcare dollars, as you can choose to save or spend the funds based on your immediate and long-term needs.

Considerations

While HDHPs and HSAs offer several financial benefits, they’re not suitable for everyone. High out-of-pocket costs before meeting the deductible could be financially stressful for some people. Be sure to assess your health needs and financial situation carefully before opting for this combination.

Summary

Choosing the right health insurance plan is crucial for both your physical and financial well-being. From understanding different types of insurance plans like HMOs, PPOs, EPOs, and HDHPs to weighing key aspects such as premiums, deductibles, and out-of-pocket costs, there’s a lot to consider. Your personal needs, such as your health status, choice of healthcare providers, and budget, also play a significant role in making an informed decision. For California residents, it’s equally important to be aware of state-specific options and rules.

Contact us

Navigating the world of health insurance can be complex, but you don’t have to do it alone. If you’re still uncertain about what plan is best for you, consider consulting a professional for personalized advice. Remember, the right plan today can save you a lot of stress, time, and money in the long run.

If you found this guide helpful, we encourage you to share it with friends and family who might also benefit. For more information, resources, and expert advice on choosing a health insurance plan, feel free to contact us or visit our Website