Understanding Medicare Basics

Medicare is a federal health insurance program for people aged 65 or older, certain younger people with disabilities, and individuals with End-Stage Renal Disease. The complexity of Medicare can be daunting, so let’s break it down into its four main parts:

- Part A (Hospital Insurance): This covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. Most people don’t pay a premium for Part A if they have worked and paid Medicare taxes for a certain period.

- Part B (Medical Insurance): Part B covers certain doctors’ services, outpatient care, medical supplies, and preventive services. Unlike Part A, Part B requires a monthly premium.

- Part C (Medicare Advantage Plans): These are Medicare-approved plans offered by private companies that bundle Part A and Part B and often include Part D. They may offer extra benefits and have different rules, costs, and restrictions.

- Part D (Prescription Drug Coverage): This part covers the cost of prescription drugs. Part D plans are run by Medicare-approved private insurance companies.

Understanding these parts is crucial as they form the foundation of your Medicare coverage and will influence your healthcare decisions as you transition to this new stage of healthcare coverage.

Medicare and Other Insurance

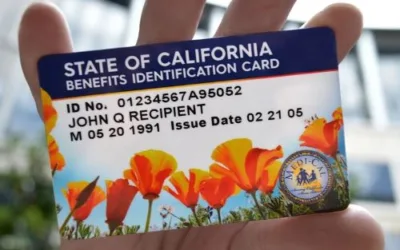

When you have Medicare along with other insurance, such as employer coverage or Medicaid, it’s essential to understand how these plans work together. The coordination of benefits is key to ensuring your healthcare costs are covered effectively. If you’re still employed, your employer insurance typically works with Medicare to determine which insurer pays first. Medicaid and Medicare can also be coordinated for those eligible, often covering most healthcare costs.

Costs and Budgeting

Navigating the costs associated with Medicare is crucial for effective budgeting. Medicare involves premiums, deductibles, copayments, and coinsurance, each representing different types of out-of-pocket expenses. Premiums are the monthly cost for your plan; deductibles are the amount you pay for services before your insurance begins to pay; copayments are a fixed amount for a covered service, paid after you’ve paid your deductible; and coinsurance is typically a percentage of the cost for covered services. Understanding these terms and how they apply to your chosen Medicare plans will help you anticipate your healthcare spending better.

Changing Plans

Your healthcare needs can change over time, and Medicare offers flexibility to adjust your coverage. You can make changes to your plan during the annual Open Enrollment Period, from October 15 to December 7 each year. Additionally, if you experience certain life events, such as moving or losing current coverage, you may be eligible for a Special Enrollment Period to make changes outside the usual time frames.

Avoiding Scams

With Medicare, it’s vital to stay vigilant about potential scams. Scammers often pose as Medicare representatives to steal personal information. Be wary of unsolicited calls or emails requesting your Medicare number or personal information. Medicare will never ask for personal details over the phone unless you initiated the conversation. Remember, your Medicare number is private and should only be given to healthcare providers or trusted Medicare intermediaries.

Medicare Resources

For assistance with Medicare, you can utilize a variety of resources:

- Medicare.gov: The official U.S. government site for Medicare.

- 1-800-MEDICARE: Contact for personalized assistance.

- State Health Insurance Assistance Programs (SHIP): Offer local, personalized counseling and assistance.

- Local Community Organizations: Many offer workshops and one-on-one counseling.

Checklist for Transitioning to Medicare

A smooth transition to Medicare can be facilitated by following a checklist:

- Understand your current coverage: Know what your current health insurance covers and how it might change.

- Know key dates: Mark enrollment periods and deadlines on your calendar.

- Assess your health care needs: Consider your routine services, medications, and any anticipated changes.

- Compare plans: Look at the costs and benefits of different Medicare plans.

- Check your eligibility for assistance programs: See if you qualify for Extra Help or Medicaid.

- Protect your personal information: Be cautious of unsolicited contacts and protect your Medicare Number.

- Finalize enrollment: Decide on your plans and complete the enrollment process.

- Review annually: Your needs may change, so review your coverage each year during the Open Enrollment Period.

Transitioning to Medicare: Decoding Your Choices

Turning 65 ushers in a new phase of healthcare decisions as you transition from a Covered California plan, employee sponsered plan or other private healthcare plan to Medicare. In our previous blog post, we laid out the basics of making this shift. In this article, we’ll dive deeper into the decisions you’ll make once you’ve received your Medicare Part A and Part B cards. Will you get a Medicare Supplement Plan, a drug plan, or a Medicare Advantage Plan? Let’s examine our options.

The Medicare Decisions Begin

Once enrolled in Medicare Parts A and B, which cover hospital and medical insurance, the next decision is how to manage the remaining healthcare expenses not covered by these plans. For this, you have two broad options: opting for a Medicare Supplement Plan (also known as Medigap) and a separate Part D (drug plan), or selecting a Medicare Advantage Plan, which often includes prescription drug coverage.

To illustrate these choices, let’s explore two scenarios: George, who opts for a Medicare Supplement and Drug Plan, and Rita, who decides on a Medicare Advantage Plan.

George’s Story: Choosing a Medicare Supplement and Drug Plan

George is an active and relatively healthy individual who wanted a robust healthcare plan without unexpected costs. His first step was to select a drug plan. George entered his prescription information into an online quote system that compared various drug plans, making it easier to identify the best fit for his needs.

Next, George contemplated the different Medicare Supplement Plans. His focus was on Plans F, G, and N, which offer extensive coverage for out-of-pocket costs not covered by Medicare Parts A and B, such as copayments, deductibles, and even excess charges by doctors outside of Medicare’s network. George finally decided on Plan G, as it offered a balance between comprehensive coverage and value. While the premium was slightly higher, George felt that the knowledge of minimal out-of-pocket expenses was worth it.

George’s story underlines the advantage of a Medicare Supplement Plan: peace of mind. While the premiums might be higher than Medicare Advantage Plans, the extensive coverage and freedom to choose any healthcare provider accepting Medicare make it an attractive option for some.

Rita’s Story: Finding a Budget-Friendly Medicare Advantage Plan

Rita, unlike George, is on a fixed income and needs a comprehensive, yet affordable, Medicare plan. Initially, she considered Medicare Supplement Plans but soon realized they were beyond her budget despite their extensive coverage.

Rita then shifted her focus to Medicare Advantage Plans. After thorough research, she found several options in her locale that were more affordable. She decided on a plan that included prescription drug coverage, eliminating the need for a separate drug plan. This plan also offered dental and vision benefits, an added perk that Rita appreciated.

What swayed Rita towards the Medicare Advantage Plan was its affordability. However, it came with a trade-off: she had to use healthcare providers within a specified network. This limited her choices, which was a disappointment.

The Choice is Yours

George and Rita’s stories illustrate the paths many seniors face when transitioning to Medicare. The decision between a Medicare Supplement Plan and a Medicare Advantage Plan is highly personal and should be based on your individual healthcare needs, budget, and lifestyle.

For those like George, who are willing to pay higher premiums for extensive coverage and greater choice in healthcare providers, a Medicare Supplement Plan may be a perfect fit. Meanwhile, those on a budget like Rita might find a Medicare Advantage Plan more suitable, even with its network restrictions.

Navigating these choices can be challenging. But remember, the goal is to ensure you have the healthcare you need in this new chapter of your life. Use tools available to compare plans, consider consulting with a healthcare advisor, and don’t hesitate to ask us any questions – we’re here to guide you every step of the way.

With proper information and support, you can make the right decision for your health and happiness in your golden years.

This article was written by Mark Svetlik, with the assistance of automation technology. The content has undergone thorough editing and fact-checking to ensure complete accuracy.