Obtaining and Understanding Your Covered California 1095-A Form

The Covered California 1095-A form is an essential document for anyone who has enrolled in a health plan through Covered California. This form is critical when filing your taxes and ensuring you get the proper credits or refunds. This post provides a complete guide on how to obtain this form and why it’s crucial for your tax filing.

How to Obtain Your Covered California 1095-A Form Online

- Visit the official Covered California website: Go to www.coveredca.com.

- Log in to your account: Click the “Sign In” button located at the top right corner of the homepage.

- Enter your credentials: Use your username and password to log into your account. If you don’t have an account, you’ll need to create one.

- Navigate to tax documents: Once logged in, look for the section containing your tax documents, labeled as “Tax Documents,” “Tax Forms,” or something similar.

- Locate Form 1095-A: This form is usually labeled as “Form 1095-A” and pertains specifically to the Health Insurance Marketplace.

- Download and save: Save a PDF copy of your 1095-A form to your computer.

If you encounter any issues while obtaining your 1095-A form online, contact the Covered California customer service helpline for assistance.

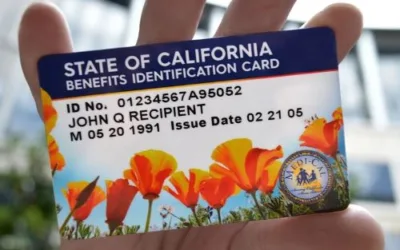

How to Obtain Your Covered California 1095-A Form In-Person

If you enrolled through a Covered California Enrollment Center, follow these steps:

- Locate the Enrollment Center: Find the center where you initially enrolled.

- Visit or schedule an appointment: Call ahead to confirm availability or make an appointment.

- Request the form: Upon arrival, ask the staff for a copy of your 1095-A form.

- Identity verification: Be ready to show a valid ID or other documents for identity verification.

- Receive your form: The staff will provide a printed or electronic copy of your 1095-A form.

Why You Need to Provide a 1095-A When Filing Taxes

The 1095-A form is essential for the IRS for the following reasons:

- Reconciling tax credits: If you received advance payments of the premium tax credit, you’ll need to reconcile these amounts.

- Claiming refunds: The form allows you to claim any due premium tax credits.

- Accurate tax filing: Including your 1095-A ensures your tax return is complete, avoiding processing delays or penalties.

What to Do If Your 1095-A Form Is Incorrect

- Contact Covered California: If you find errors, immediately reach out to Covered California’s customer service.

- Provide Correct Information: Offer the accurate details to amend the form.

- Follow the guidelines: Adhere to any steps provided by Covered California to correct your form.

What If You Didn’t Receive a 1095-A Form?

- Check online: Log in to your Covered California account to check for the form.

- Contact customer service: If you still can’t find it, call the Covered California helpline.

- Visit an Enrollment Center: If time is of the essence, consider obtaining the form in person from an Enrollment Center.

How to Store Your 1095-A Form Safely

- Digital Storage: Save a secure, password-protected digital copy.

- Physical Storage: Print and store the form in a secure location.

- Avoid Email: Never email this sensitive document to yourself or others.

Important Deadlines, Penalties, and Terms You Should Know

Deadline for Receiving 1095-A

If you’ve enrolled in a health plan through Covered California, you should expect to receive your Form 1095-A by January 31st. This is usually sent via mail, but many people can also access it online through their Covered California account. Make sure to keep an eye on your mailbox or account as the tax season approaches, and reach out to Covered California if you haven’t received your form by the second week of February.

Penalties for Filing Late Due to Missing 1095-A

Not having your 1095-A on time can affect your ability to file your tax returns by the deadline, which is typically April 15th. Late filing can result in various penalties, such as:

- Failure-to-File Penalty: Usually 5% of the unpaid taxes for each month or part of a month that your return is late.

- Interest Charges: The IRS may charge interest on the unpaid balance.

- Loss of Refund: If you are entitled to a refund but do not file within three years, you could forfeit your refund to the U.S. Treasury.

If you have not received your form on time, immediately contact Covered California to remedy the situation and consider filing for an extension to avoid these penalties.

Glossary of Terms

Navigating the intricacies of Form 1095-A can be confusing. Here are some commonly used terms to help you understand better:

- Premium Tax Credit (PTC): A tax credit you can claim to help cover the cost of premiums for health insurance purchased through the Marketplace.

- Household: Generally consists of the tax filer, spouse if filing jointly, and dependents.

- Reconciliation: The process of comparing the advance Premium Tax Credits received to the actual credit you qualify based on your final income for the year.

- Health Insurance Marketplace: The service that helps people shop for and enroll in affordable health insurance.

- Form 8962: The tax form used to reconcile your Premium Tax Credits.

By understanding these deadlines, potential penalties, and key terms, you’ll be better equipped to navigate the tax implications of your health coverage through Covered California.

Frequently Asked Questions (FAQs)

- Can I file my taxes without a 1095-A form?

- No, you’ll need this form for accurate tax filing if you used Covered California.

- What should I do if I’ve lost my 1095-A form?

- You can download a new one from your Covered California account or obtain it from an Enrollment Center.

- Is a 1095-A form the same as a W-2 or 1099 form?

- No, the 1095-A is specifically for reporting health insurance coverage from the Marketplace.

Feel free to contact the Covered California customer service or visit an Enrollment Center for more help and information.

This article was written by Mark Svetlik, with the assistance of automation technology. The content has undergone thorough editing and fact-checking to ensure complete accuracy.